Top 7 Payment Gateways for Your Ecommerce Website

In the world of ecommerce, having a reliable payment gateway is essential for any business. With so many options out there, it can be overwhelming to determine which one is the best fit for your specific needs.

That’s why we’re here to help. In this article, we’ll explore the top payment gateways on the market, their strengths and weaknesses, and how they can benefit your business.

If you’re tired of dealing with slow transaction speeds, cumbersome fees, or unreliable security measures, you’re not alone.

These pain points are shared by many online businesses, and that’s where our expertise comes in. We understand the challenges you face when it comes to payment processing, and we’re here to provide solutions.

Our team has extensively researched and tested the best cheapest payment gateways available today, and we’re confident that we can help you find the one that’s right for you.

Whether you’re looking for a streamlined checkout process, top-notch security features, or competitive pricing, we’ve got you covered.

At our company, we believe that your success is our success. That’s why we’re committed to providing you with the most reliable and efficient payment gateway solutions on the market.

Don’t let payment processing hold your business back any longer - let us help you take your ecommerce game to the next level.

What is a Payment Gateway?

A payment gateway is a software or service that securely processes transactions and authorizes payments between customers and sales providers.

It acts as a middleman, connecting your customers’ banks or financial institutions with your online retail space.

Simply put, it authenticates the exchange between the buyer and seller and ensures that both parties get what they expect. Some popular payment gateway providers include PayPal, Stripe, and Square etc..

Points to be Considered While Selecting a Payment Gateways:

When selecting a payment gateway, there are several important points to consider:

1. Security:

It is crucial to choose a payment gateway that offers the highest level of security to protect both your customers’ financial information and your business’s reputation.

Look for payment gateways that use SSL encryption and comply with the Payment Card Industry Data Security Standard (PCI-DSS).

2. Transaction fees:

Payment gateways charge a fee for each transaction, and these fees can vary significantly from one provider to another.

Be sure to compare fees and choose a payment gateway that offers reasonable rates without compromising on security and reliability.

3. Integration:

The payment gateway should be easy to integrate with your website or ecommerce platform.

Check if the payment gateway provider offers APIs, plugins or ready-to-use integration modules that match your platform.

4. Payment methods:

Different payment gateways offer different payment methods, including credit cards, debit cards, net banking, e-wallets, and others.

Ensure the payment gateway supports payment methods that are commonly used by your customers.

5. Customer support:

Technical glitches can happen at any time. Hence, choose a payment gateway that provides reliable and responsive customer support.

6. Reputation:

Do some research on the payment gateway provider’s reputation in the market. Check reviews and ratings, customer feedback, and how long they have been in the business.

Overview of the top 7 payment gateways Providers:

There are many payment gateways available for ecommerce businesses, but we have identified the top 7 based on popularity, features, and reliability. These include:

- PayPal

- Stripe

- Authorize.net

- Square

- Amazon Pay

- Braintree

- Payoneer

Each of these payment gateways offers unique features and benefits, such as advanced fraud prevention tools, a wide range of payment options, and user-friendly interfaces.

In the following sections, we will provide more in-depth information about each payment gateway, their pricing and fees, and their pros and cons, to help ecommerce businesses make an informed decision about which payment gateway is right for them.

Top 5 payment gateways for online transactions:

1. PayPal

PayPal is one of the most popular payment gateways for ecommerce businesses. It allows customers to make payments using their PayPal account, credit card, or debit card. Here are some of the features and benefits of using PayPal:

A. Features and benefits

- Security: PayPal is a secure payment gateway that protects both the buyer and seller from fraud and unauthorized transactions.

- User-friendly: PayPal is easy to set up and use. It offers a simple and intuitive user interface, making it convenient for customers to make payments.

- Mobile payments: PayPal offers mobile payment options, making it easy for customers to make payments using their mobile devices.

- International payments: PayPal allows businesses to accept payments from customers around the world in multiple currencies.

- Integration: PayPal can be easily integrated with ecommerce platforms like WooCommerce, Shopify, and Magento.

B. Pricing and fees

- PayPal charges a transaction fee of 2.9% + $0.30 per transaction.

- For international payments, PayPal charges a cross-border fee of 1.5% to 2.5% depending on the country.

- PayPal also offers other services such as PayPal Pro and PayPal Here, hich have additional fees.

C. Pros and cons

- Pros:

Widely recognized and trusted by customers

Easy to set up and use

Secure payment processing

Mobile payments and international payments available - Cons:

Transaction fees can add up for high-volume businesses

PayPal may hold funds for a certain period of time in some cases

D. Comparison with other payment gateways providers

- Compared to Stripe, PayPal has a higher transaction fee but offers more international payment options.

- Compared to Authorize.net, PayPal is more user-friendly and has lower setup fees.

Overall, PayPal is a reliable and convenient payment gateway for ecommerce businesses of all sizes.

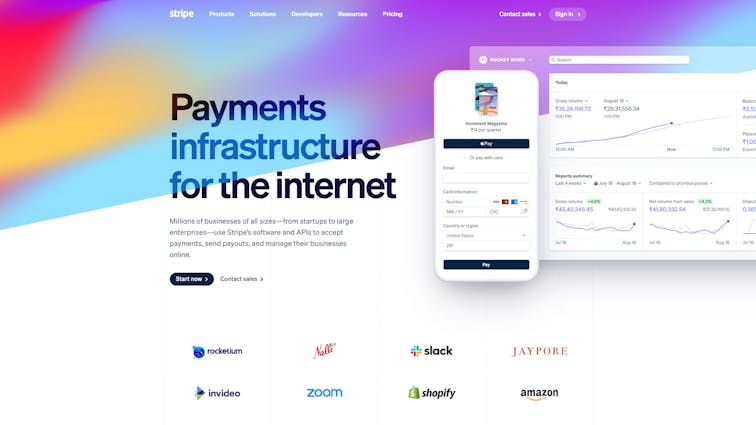

2. Stripe

Stripe is a payment gateway that has gained popularity in recent years due to its modern features and user-friendly interface. Here are some of the features and benefits of using Stripe:

A. Features and benefits

- Customizable: Stripe offers a high level of customization, allowing businesses to tailor the checkout experience to their brand and customers’ preferences.

- Subscription billing: Stripe has robust subscription management tools, making it easy for businesses to handle recurring payments and subscriptions.

- Mobile payments: Stripe offers mobile payment options and has a mobile SDK that enables businesses to integrate payments into their mobile apps.

- International payments: Stripe allows businesses to accept payments in over 135 currencies and has a sophisticated system for handling international payments.

- Fraud prevention: Stripe has advanced fraud detection and prevention tools to protect businesses from fraudulent transactions.

B. Pricing and fees

- Stripe charges a transaction fee of 2.9% + $0.30 per transaction.

- For international payments, Stripe charges an additional 1% conversion fee.

- Stripe offers additional services like Stripe Connect and Stripe Billing, which have separate fees.

C. Pros and cons

- Pros:

Customizable checkout experience

Robust subscription management tools

Mobile payments and international payments available

Advanced fraud prevention measures - Cons:

Not as widely recognized as some other payment gateways

Some users may find the pricing structure confusing

D. Comparison with other payment gateways providers

- Compared to PayPal, Stripe has a lower setup fee and offers more customization options, but has a higher transaction fee.

- Compared to Authorize.net, Stripe has a more modern and user-friendly interface and offers more features like subscription management.

Overall, Stripe is a great payment gateway for businesses that value customization and modern features.

3. Authorize.net

Authorize.net is a payment gateway that has been in operation for over 20 years. It offers a wide range of payment options and features for businesses of all sizes. Here are some of the features and benefits of using Authorize.net:

A. Features and benefits

- Payment options: Authorize.net offers a variety of payment options, including credit and debit cards, eChecks, and digital payment solutions like Apple Pay and PayPal.

- Fraud prevention: Authorize.net has advanced fraud detection and prevention tools to protect businesses from fraudulent transactions.

- Recurring payments: Authorize.net has features for handling recurring payments and subscription billing.

- Mobile payments: Authorize.net has a mobile app that enables businesses to accept payments on-the-go.

- Integration: Authorize.net can be easily integrated with many popular ecommerce platforms like Shopify and Magento.

B. Pricing and fees

- Authorize.net charges a setup fee of $49 and a monthly gateway fee of $25.

- Transaction fees vary depending on the payment method and volume of transactions.

- Authorize.net also offers additional services like Advanced Fraud Detection Suite and Customer Information Manager, which have additional fees.

C. Pros and cons

- Pros:

Wide range of payment options

Advanced fraud prevention measures

Recurring payment and subscription billing features

Mobile payments and integration with popular ecommerce platforms - Cons:

Higher setup fee and monthly gateway fee than some other payment gateways

Transaction fees can add up for high-volume businesses

D. Comparison with other payment gateways providers

- Compared to PayPal, Authorize.net offers more payment options and advanced fraud prevention tools, but has a higher setup fee and monthly gateway fee.

- Compared to Stripe, Authorize.net has a longer history and more established reputation, but may be less user-friendly and customizable.

Overall, Authorize.net is a reliable payment gateway for businesses that prioritize security and a wide range of payment options.

However, it may not be the best fit for businesses with lower transaction volumes due to its setup and monthly fees.

4. Square

Square is a payment gateway that has become increasingly popular in recent years. It offers a range of payment and business management solutions for small to medium-sized businesses. Here are some of the features and benefits of using Square:

A. Features and benefits

- Payment options: Square offers a variety of payment options, including credit and debit cards, mobile payments, and digital wallets like Apple Pay and Google Wallet.

- Point of sale: Square offers a range of point of sale solutions, including mobile card readers and registers, making it easy for businesses to accept payments on-the-go.

- Invoicing: Square allows businesses to send invoices and accept payments online.

- Business management: Square has additional tools for managing inventory, appointments, and employee payroll.

- Integration: Square can be easily integrated with many popular ecommerce platforms like WooCommerce and Magento.

B. Pricing and fees

- Square charges a transaction fee of 2.9% + $0.30 per transaction.

- For in-person transactions using a card reader, Square charges a slightly lower fee of 2.6% + $0.10 per transaction.

- Square also offers additional services like Square Terminal and Square for Retail, which have additional fees.

C. Pros and cons

- Pros:

Wide range of payment options

User-friendly point of sale solutions

Invoicing and business management tools available

Integration with popular ecommerce platforms - Cons:

Higher transaction fees than some other payment gateways

Some users may find the customer support to be lacking

D. Comparison with other payment gateways providers

- Compared to PayPal, Square offers more point of sale solutions and business management tools, but has a higher transaction fee.

- Compared to Stripe, Square has a more robust point of sale system and additional business management tools, but may be less customizable and have higher fees.

5. Amazon Pay

Amazon Pay is a payment gateway that allows customers to use their Amazon account to make purchases on other ecommerce sites. Here are some of the features and benefits of using Amazon Pay:

A. Features and benefits

- User convenience: Amazon Pay allows customers to use their existing Amazon account to make purchases, eliminating the need to enter payment and shipping information.

- Trust: Customers trust Amazon and are more likely to make purchases on other sites that offer Amazon Pay.

- Fraud protection: Amazon Pay has advanced fraud detection and prevention tools to protect businesses from fraudulent transactions.

- International payments: Amazon Pay allows businesses to accept payments from customers around the world in multiple currencies.

- Integration: Amazon Pay can be easily integrated with ecommerce platforms like WooCommerce, Shopify, and Magento.

B. Pricing and fees

- Amazon Pay charges a transaction fee of 2.9% + $0.30 per transaction.

- There are no setup or monthly fees for using Amazon Pay.

C. Pros and cons

- Pros:

User convenience and trust

Advanced fraud prevention measures

Mobile payments and international payments available

Easy integration with popular ecommerce platforms - Cons:

Limited customization options compared to some other payment gateways

May not be as widely recognized as some other payment gateways

D. Comparison with other payment gateways providers

- Compared to PayPal, Amazon Pay offers more trust and convenience for customers, but has a higher transaction fee.

- Compared to Stripe, Amazon Pay may be less customizable and have fewer features, but is easier to use and more widely recognized.

Overall, Amazon Pay is a convenient and secure payment gateway for businesses that want to offer their customers a trusted and user-friendly checkout experience.

6. Braintree

Braintree is a payment gateway owned by PayPal and offers a variety of payment and business management solutions for online merchants. Here are some of the features and benefits of using Braintree:

A. Features and benefits

- Payment options: Braintree allows businesses to accept various payment options, including credit and debit cards, PayPal, Venmo, and digital wallets like Apple Pay and Google Pay.

- Fraud protection: Braintree offers advanced fraud prevention tools, such as 3D Secure, to protect businesses from fraudulent transactions.

- Global payments: Braintree accepts payments from customers worldwide and supports over 130 currencies.

- Customization: Braintree allows businesses to create a fully customized checkout experience with their flexible API.

- Integration: Braintree can be easily integrated with popular ecommerce platforms like Shopify, WooCommerce, and Magento.

B. Pricing and fees

- Braintree charges a transaction fee of 2.9% + $0.30 per transaction.

- There are no setup or monthly fees for using Braintree.

C. Pros and cons

- Pros:

Wide range of payment options, including PayPal and Venmo

Advanced fraud prevention measures

Global payment processing support

Customizable checkout experience with flexible API - Cons:

Transaction fees may be higher than some other payment gateways

As a PayPal-owned company, may share some of the same limitations and challenges experienced with PayPal

D. Comparison with other payment gateways providers

- Compared to PayPal, Braintree offers more customization options, advanced fraud protection tools, and support for additional payment options like Apple Pay and Google Pay.

- Compared to Stripe, Braintree offers a similar range of features and fees but may be more attractive to merchants already familiar with or using PayPal services.

Overall, Braintree is an excellent payment gateway for businesses that require a highly customizable and robust solution for accepting a wide range of payment options, while also benefiting from the trust and recognition associated with its parent company, PayPal.

7. Payoneer

Payoneer is a versatile payment gateway focused on helping businesses process cross-border payments efficiently. Here are some of the key features and benefits of using Payoneer:

A. Features and benefits

- Cross-border payments: Payoneer specializes in providing payment solutions for businesses involved in cross-border and international transactions.

- Global payment solutions: Payoneer allows businesses to accept payments in more than 150 currencies from customers worldwide and supports up to 70 countries for direct bank transfers.

- Flexible payout options: Payoneer provides multiple payout options, such as direct bank transfers, prepaid Mastercard, or payments to another Payoneer account.

- Mass payment solutions: Payoneer offers a convenient mass payment solution to simplify the process of sending multiple payments at once to suppliers, partners, or affiliates.

- Ecommerce integration: Payoneer can be integrated with popular ecommerce platforms like Shopify, WooCommerce, and Amazon.

B. Pricing and fees

- Payoneer offers various pricing plans depending on the specific services the business requires. Transaction fees may include currency conversion fees, direct bank transfer fees, and card withdrawal fees.

- There are no setup or monthly fees for using Payoneer’s basic payment gateway solution.

C. Pros and cons

- Pros:

Specializes in cross-border and international transactions

Supports a wide range of currencies and payout options

Easier and more affordable international payments compared to some traditional banking solutions

Mass payment solution for businesses with multiple international payouts - Cons:

Pricing can vary depending on the specific services required, which may be more complex than other payment gateways

Payoneer’s focus on cross-border payments may make it less appealing for businesses serving predominantly local customers

D. Comparison with other payment gateways providers

- Compared to PayPal, Payoneer’s fees are typically lower for international transactions, and it doesn’t charge additional fees for currency conversion.

- Compared to Stripe and Amazon Pay, Payoneer may offer fewer features and customization options but provides a more specialized solution for businesses involved in cross-border and international transactions.

Overall, Payoneer is an ideal payment gateway for businesses that frequently deal with international customers and require efficient, flexible, and cost-effective solutions for managing cross-border payments.

CONCLUSION:

Final recommendations for ecommerce businesses Ultimately, the best payment gateway for a business will depend on its specific needs and priorities.

However, we recommend considering PayPal and Stripe as top choices due to their popularity, robust features, and wide range of payment options.

For businesses that prioritize security and customization, Authorize.net may be a good fit. For businesses that want a user-friendly and affordable solution, Square may be a good option.

And for businesses that want to offer their customers a trusted and convenient checkout experience, Amazon Pay may be a good choice.

FAQ’s:

1: Which payment gateway support UPI?

There are several payment gateways that support UPI (Unified Payments Interface), a popular payment system in India. Some of the payment gateways that support UPI include:

- Razorpay

- Paytm

- Instamojo

- CCAvenue

- BillDesk

These payment gateways enable businesses to accept payments through UPI on their ecommerce websites and mobile apps, making it easier for customers to make online payments using their UPI ID or QR code. It’s important to check with the payment gateway provider to ensure that UPI is supported and integrated with their platform.

2: Do I need a payment gateway to accept payments on my ecommerce website?

Yes, you will need a payment gateway to accept online payments on your ecommerce website. It’s a crucial component of the payment process, as it ensures that transactions are secure and processed efficiently.

3: Are there any hidden fees with payment gateways?

While most payment gateways are transparent about their pricing and fees, it’s always a good idea to read the fine print and understand the terms and conditions before signing up. Some gateways may charge additional fees for certain transactions or services, so it’s important to do your research and compare different options.

4: Can I switch payment gateways later on?

Yes, you can switch payment gateways at any time if you’re not satisfied with your current provider or if you find a better option that suits your business needs. However, keep in mind that switching gateways may involve some technical work and could temporarily interrupt your payment processing.

5: What happens if a customer disputes a transaction?

If a customer disputes a transaction, the payment gateway will usually initiate a chargeback process. This involves reviewing the transaction details and evidence from both the merchant and the customer to determine whether the charge is valid. If the charge is deemed invalid, the payment may be reversed and refunded to the customer. If it’s valid, the merchant may be liable for the chargeback fee and may need to take steps to prevent future disputes.